The recently implemented Corporate Services Providers (CSPs) Rulebook has introduced a new dimension of regulatory obligations on CSPs. The Rulebook emphasises on the importance for CSPs to implement a robust and comprehensive risk management framework proportionate to the nature, scale and complexity of their business.

Moreover, a CSP holding a Class C authorisation is required to establish and maintain a risk management function which independently implements risk management policies and procedures as set out in the rulebook and provides advice and reports to senior management.

Meeting the newly introduced risk management requirements may be a challenge for CSPs since implementing a risk management framework is not a tick-the-box exercise but a tailored approach that needs to be embedded in business processes as well as the CSP’s culture.

How can Bridge Advice assist?

At Bridge we are subject matter experts in the field of risk management, and we want to assist CSPs through this challenge by being your risk management advisor and providing an independent and tailored approach to ensure that the CSP meets all regulatory obligations. As depicted hereunder, our approach is built on three phases to reflect the requirements set out in the rulebook.

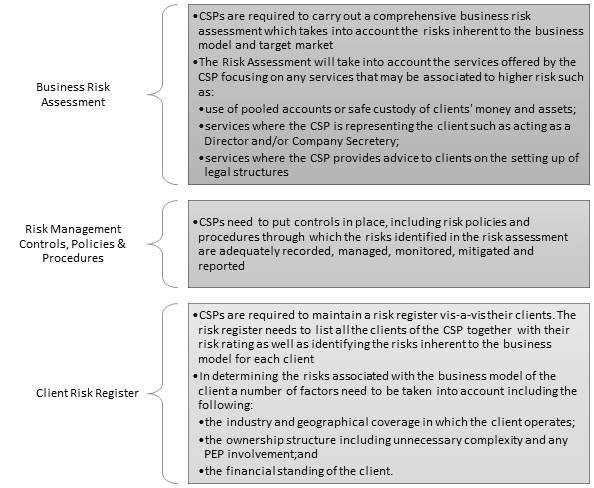

Bridge can assist CSPs to implement a tailored risk management framework whilst sharing knowledge in risk management with the staff. Bridge can provide assistance with the following:

- Assistance in carrying out a tailored risk assessment to identify risks as well as establishing those risks which are material to the business model of the CSP

- Assistance in identifying adequate controls and drafting risk policies and procedures as well as advising on how the CSP can effectively implement the risk policies and procedures and embed these practices in the day-to-day operations

- Assistance in embedding an efficient process to build a risk register which effectively identifies and captures the client risk classification and business model risk

Our Team

At Bridge we pride ourselves to be a team comprising of subject matter experts whose combined skill set assures the delivery of practical and quality advice to our clients. We believe that assisting CSP in fulfilling the requirements set out in the rulebook requires putting people on the ground who have practical experience in risk management.

Thus, the lead subject matter expert on the engagement shall be Mr. Keith Huber who specialises in Risk Management. Keith is an external consultant with Bridge Advice and has over 15 years’ experience specialising in risk management within the financial services industry, having held senior management roles in risk management in banks and funds. Since 2018 Keith has been approved by the MFSA to act as Chief Risk Officer on several MFSA licensed AIFMs.

Our Service Offering

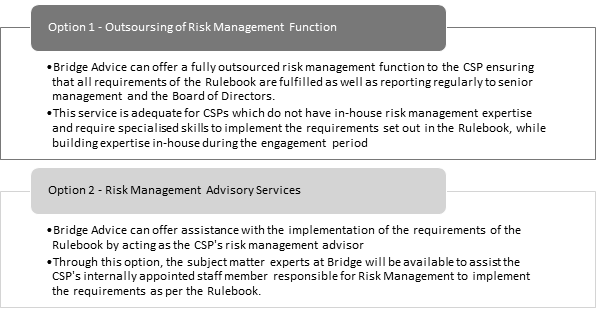

Bridge Advice is flexible to the requirements of our clients; therefore, we are offering two levels of service depending on the assistance required by CSP.

Contact us for more information:

| Roderick Psaila Managing Director Mob: +356 99393838 Email: info@bridge.mt www.bridge.mt |